Why Invest In Thailand?

A Better Way To Grow

S&P 500 Index

- A solid choice for long-term investors, averaging around 10% annually over several decades

- A great option for saving money

Investing In Thai Real Estate

- Combined Returns of up to 18% (rental yields of 7-8%, coupled with an average property appreciation rate of 10% in recent years)

- Additional lifestyle opportunities

- A ‘no-hustle’ investment

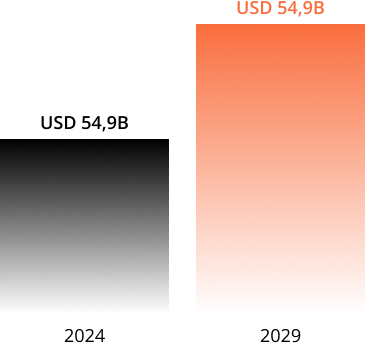

The Thailand Real Estate Market

The Thailand real estate market is projected to reach USD 54.90 billion in 2024, with an expected growth to USD 71.70 billion by 2029, growing at a compound annual growth rate (CAGR) of 5.41% during this period

Additionally, investors can anticipate consistent growth in property values, with an average appreciation rate of approximately 10% in recent years

Phuket Market

Surge in Demand:

The Phuket real estate market is experiencing a surge in demand, driven by both local and foreign investors. The island’s natural beauty, vibrant culture, and thriving tourism industry have made it a sought-after destination for property investment. This increased foreign demand is contributing to a boom in the real estate market

Active Projects and Investment:

As of early 2024, there are approximately 500 active real estate projects in Phuket valued at 470 billion baht (around USD 12.8 billion). This surge is largely driven by high demand for vacation homes and condominiums among foreign buyers. In Q1 2024 alone, there was an investment of 54 billion baht (around USD 1.47 billion) in low-rise houses and condominiums, significantly higher than pre-pandemic levels

Tourism Growth:

Phuket a racted around 8.37 million tourists in 2023, marking a 152.29% increase from the previous year. This influx solidifies Phuket’s status as a premier global destination, further driving demand for real estate

Limited Supply and High Demand:

There are currently about 72,000 units available for sale, with 62,000 already sold, leaving only about 10,000 units on the market. This limited supply amidst high demand indicates a strong market for property investment

Land Price Increases:

Land prices in Phuket have increased significantly over the years, with an average rise of 7.47 times, or about 10.7% annually, making it increasingly diicult to find aordable land for new developments

“These trends not only capture investor interest but also encourage developers to undertake ambitious projects to meet the growing demand for real estate in Phuket.”

Other Market-Defining Factors For Real Estate In Thailand

Speed Train from China

A New Airport on Phuket

Gaming Zones on Phuket

Foreign Land Ownership

Expected ROI

“This results in an expected total ROI of approximately 15% to 20% annually, positioning this investment as a compelling opportunity for capital growth and income stability.”

Rental Yield

An a ractive rental yield ranging from 5% to 10%, providing immediate cash flow and a solid foundation for ongoing income generation

Appreciation Rate

An average property appreciation rate of up to 10% per annum over recent years, enhancing the long-term value of the investment